Hindsight is 2020

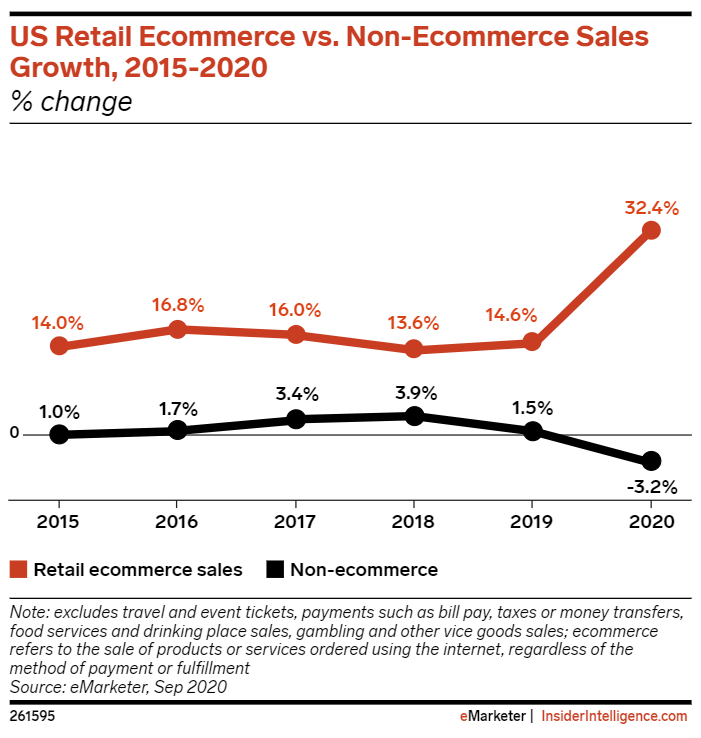

While the holiday shopping season saw unprecedented growth in online sales, the rumor of brick-and-mortar stores’ deaths have been greatly exaggerated – for some. Brands like Walmart, Macy’s, TJX, and Dollar General saw an average of 18% growth in foot traffic the weekend before Christmas. However, more than 40 major retailers have declared bankruptcy and a record 11,000-plus stores have been announced for closing in the U.S. this year, according to commercial real estate data firm CoStar Group.

The key to retail, restaurant, grocery, and most of the “normal” holiday boosted industries’ survival has been their willingness and speed to adapt to the effects of the pandemic.

While most would assume retail behemoths like Amazon and Walmart ruled the season, and they both did grow considerably, you might be surprised to see the businesses that thrived the most growth-wise this past year. In addition to Walmart, Best Buy, Target, Home Depot, and Kroger saw huge growth in 2020 online sales.

- Best Buy: 106%

- Target: 104%

- Kroger: 79%

- Home Depot: 71%

- Walmart: 65%

- Costco: 60%

- Wayfair: 51%

- Amazon: 39%

- Macy’s: 33%

- Apple: 32%

*According to Color Capital

Holiday By Industry

During the expanded 75-day holiday season tracked by MasterCard SpendingPulse, many industries saw good growth as they have most of the year:

- Home furniture and furnishings sales rose 16%

- Home-improvement sales rose 14%

- Grocery sales gained nearly 7%

- Electronics and Appliances sales climbed 6%

On the other hand, some business did not fare as well:

- Department store sales dropped 10%

- Apparel sales tumbled 19%

- Luxury items excluding jewelry slumped 21%

- Jewelry sales fell 4.3%

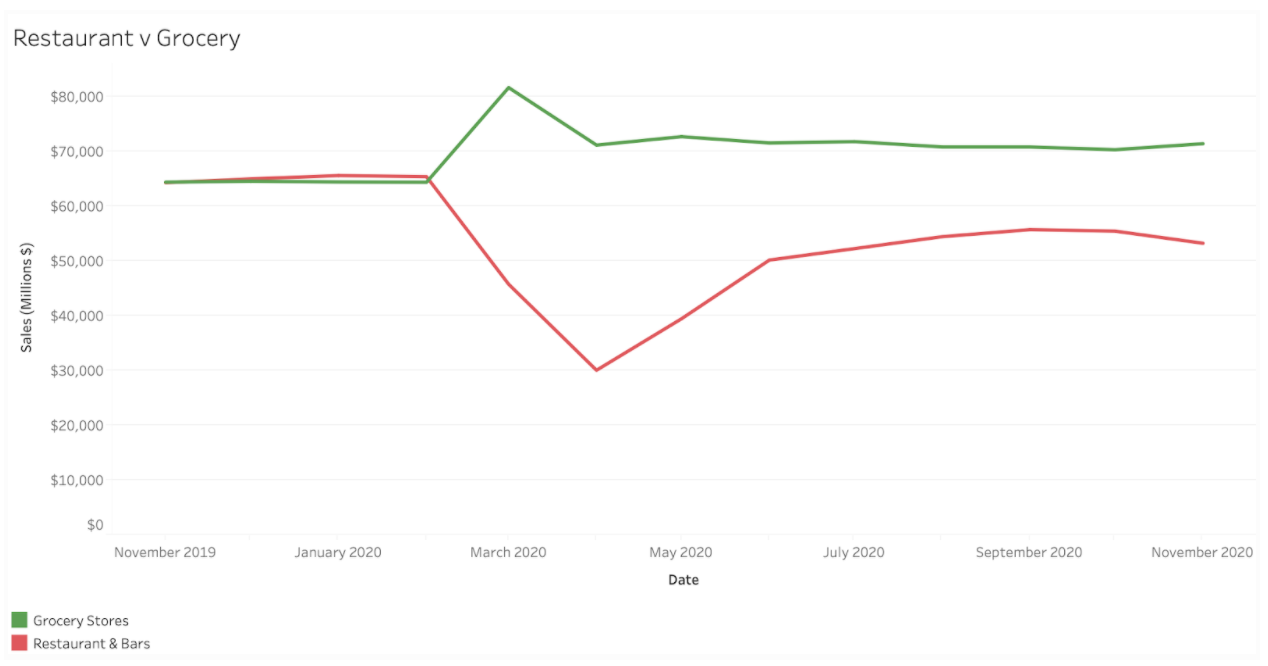

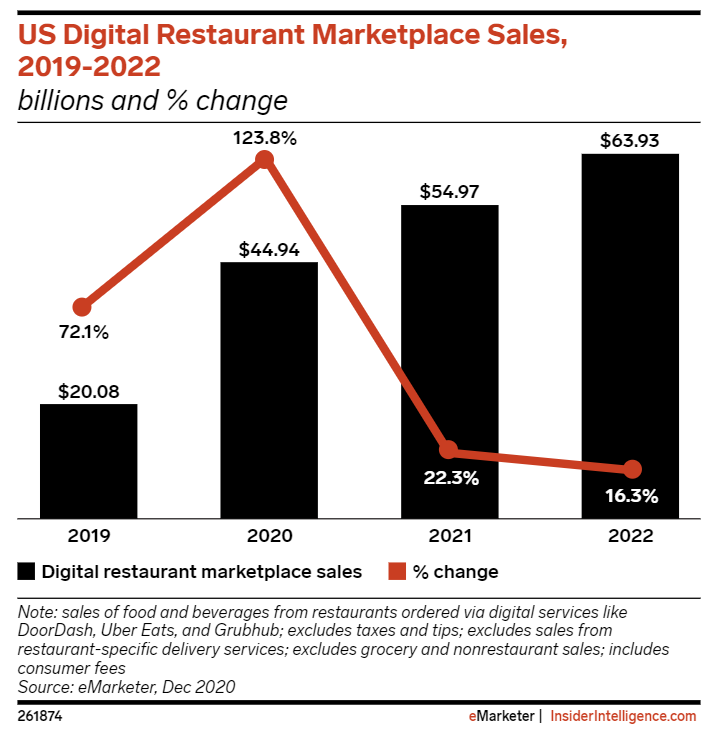

The restaurant industry was probably the hardest hit. Normally boosted during the holiday shopping season, this industry’s largest sales period, Coronavirus restrictions forced 17% of restaurants to close permanently or long term according to the National Restaurant Association. More people chose to get their caloric intake through lower risk and lower-priced options by shopping at their local grocery stores and cooking at home.

In fact, Food Service and Drinking Establishments experienced a 19% decline through November, passed only by Clothing and Accessory stores decline of 29% (although online sales grew 23% in the space).

What does this mean for 2021?

In 2021 we’ll start to see a shift in prioritizing budget allocation, one that will increase IT infrastructure needs to support the growing expectation for buy online pick up in-store, pick-and-pack (or ship from store), and curbside pick-up capabilities. This year and in the foreseeable future, stores will need to seamlessly integrate into supply chain systems, connecting all channels, enabling them to flex from both a point of fulfillment to a place of discovery. BlueSky Commerce can help through our 360 approach using modular and agile design thinking in order to capitalize on the best technology that is right for your organization, attract and satisfy a different kind of shopper, and hire the right people to support an ever-changing shopping experience where it’s more about the size of the basket and less about a number of shopping trips and visits. To learn more, schedule time with one of our consultants today – contact us.